Buying Property in Florida? Here's How to Minimize Risk and Save on Insurance

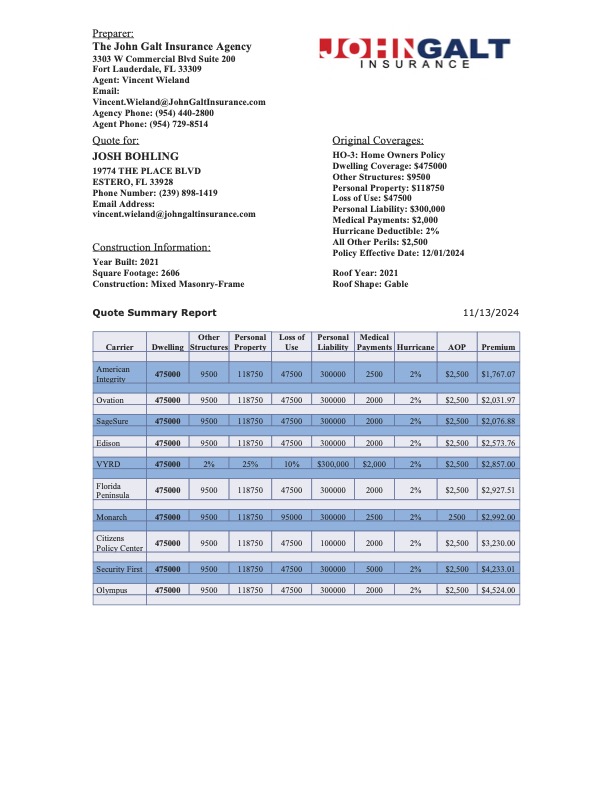

Navigating the Florida real estate market can feel daunting, especially with the added challenges of hurricanes and flooding. Luckily, there are expert-backed strategies to help you make informed decisions. Realtor Josh Bohling with LPT Realty and insurance agent Vincent Wieland with John Galt Insurance, share essential advice to protect your investment and wallet.

Categories

Recent Posts

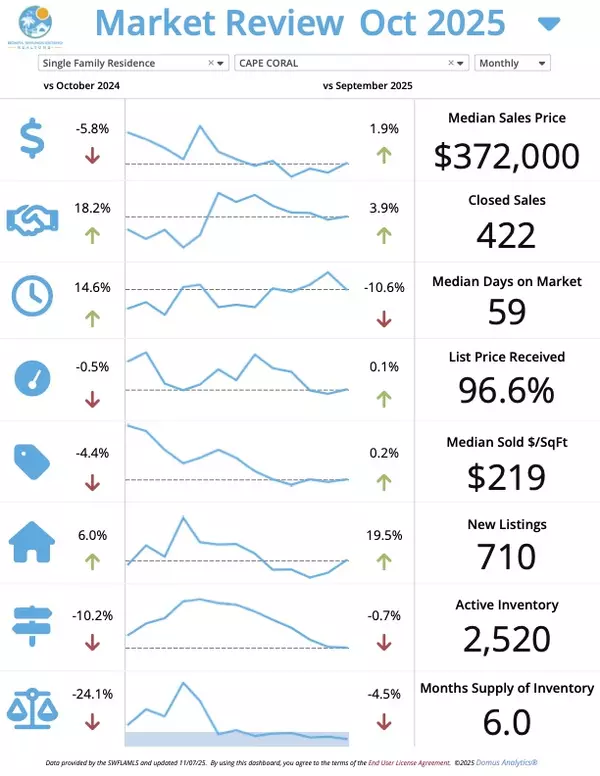

Cape Coral November Market Update-Josh Bohling - LPT Realty SW FL

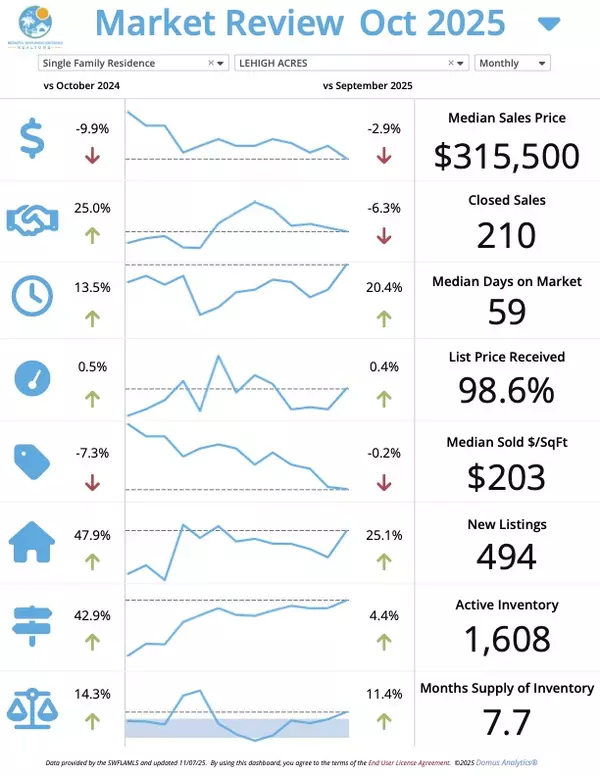

Lehigh Acres November Market Update – Josh Bohling - LPT Realty SW FL

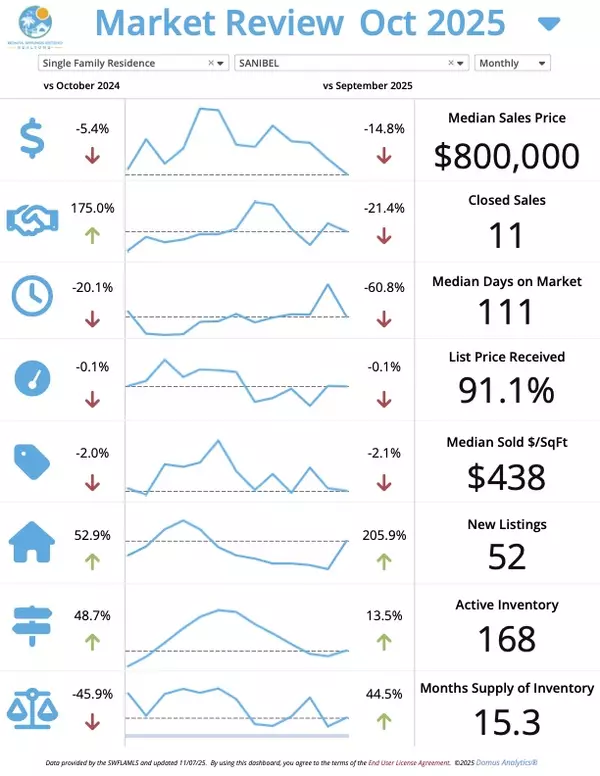

Sanibel November Market Update – Josh Bohling - LPT Realty SW FL

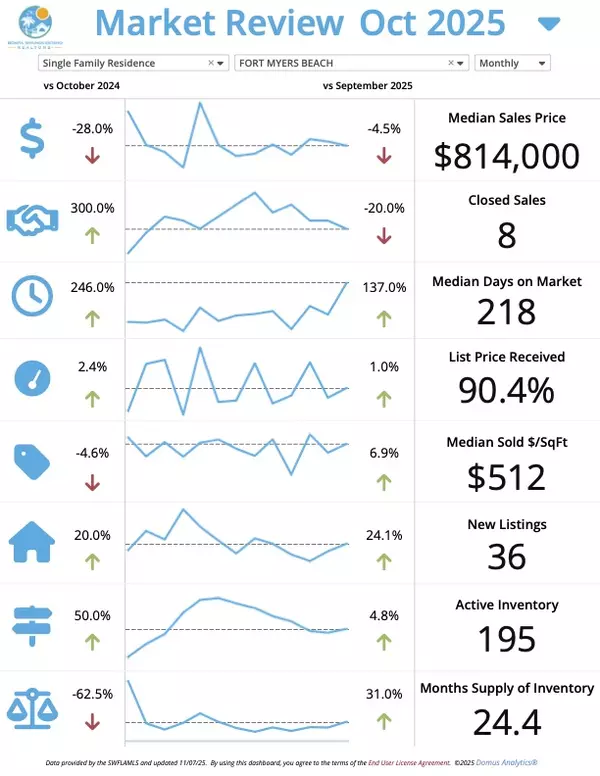

Fort Myers Beach November Market Update – Josh Bohling - LPT Realty SW FL

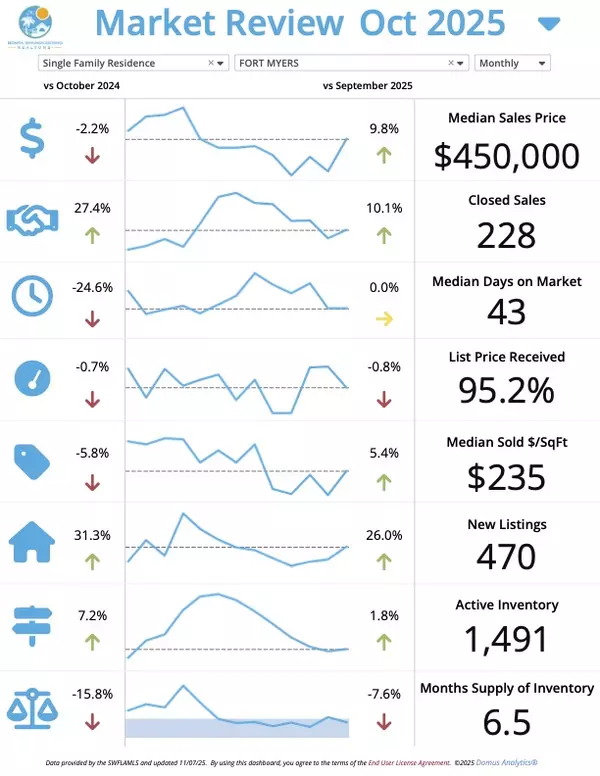

Fort Myers November Market Update – Josh Bohling - LPT Realty SW FL

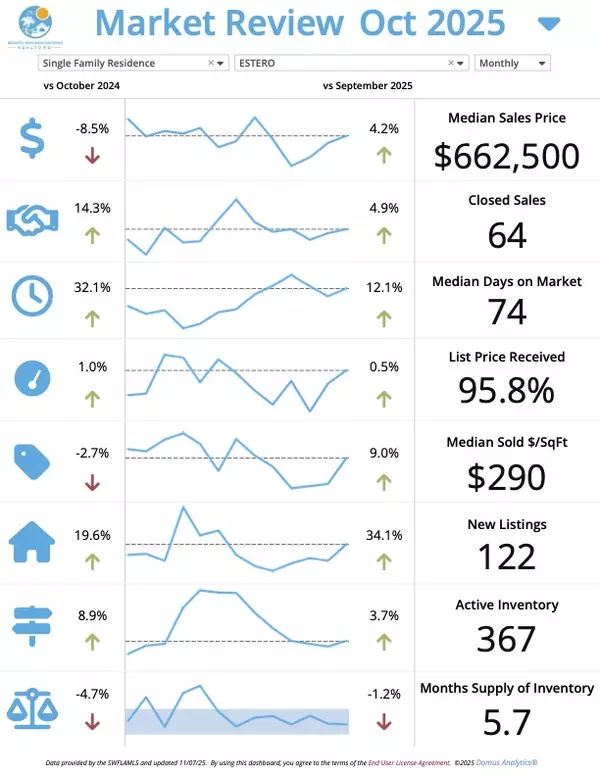

Estero November Market Update – Josh Bohling - LPT Realty SW FL

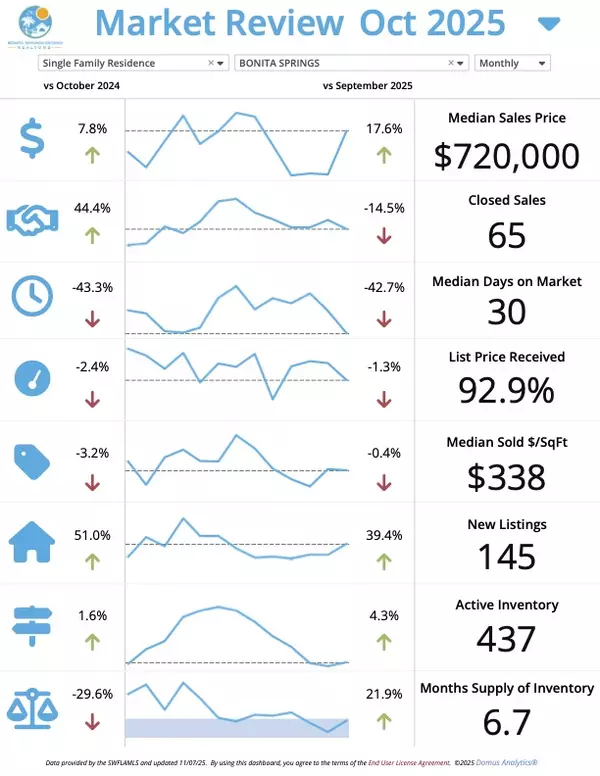

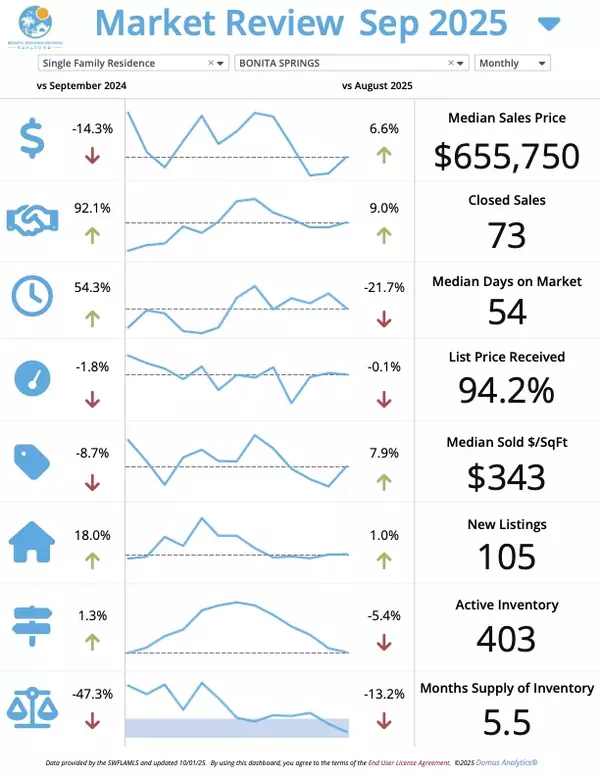

Bonita Springs November Market Update – Josh Bohling - LPT Realty SW FL

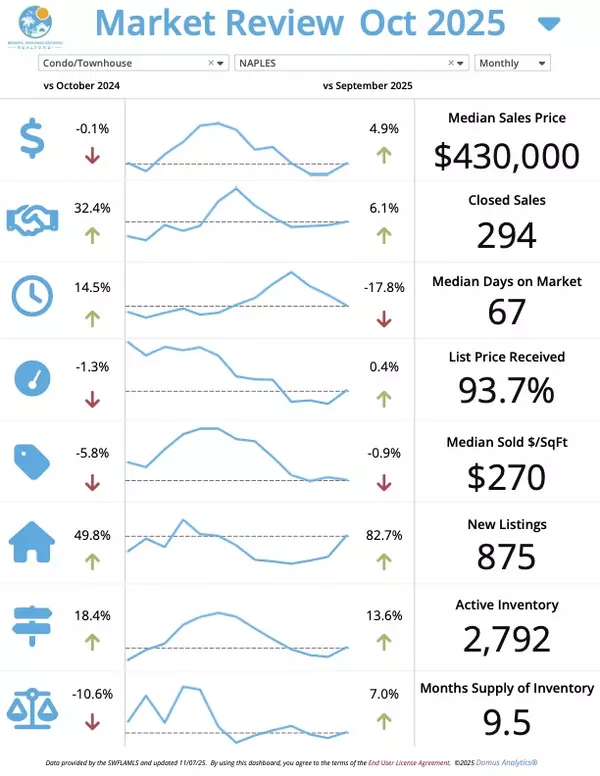

Naples November Market Update – Josh Bohling - LPT Realty SW FL

Finding a Pet-Friendly Paradise: Your Guide to Naples Communities with Dog Parks

Bonita Springs October Market Update – Josh Bohling - LPT Realty SW FL

GET MORE INFORMATION