Fed Rate Cut 9/18/24-Expectations for the future, market reaction and my thoughts.....

Market Update: Federal Reserve Rate Drop and Its Impact on Your SWFL Home Search

On September 18, 2024, the Federal Reserve made a significant announcement that could shape the future of the housing market in Southwest Florida (SWFL). They decided to drop the lending rate to commercial institutions by 50 basis points, equating to a 0.5% decrease. This move marks the first rate reduction since February 2020 and comes after a prolonged period in which rates reached a 23-year high.

What This Means for Mortgage Rates

It's important to clarify that a drop in the Federal Reserve’s rates does not automatically translate to a similar drop in mortgage rates. Prior to this announcement, we were already seeing mortgage rates decline, with many lenders quoting rates around 6% for Conventional loans and approximately 5.65% for FHA loans. The earlier discussions within the Fed pointed towards potential reductions of between 25 to 50 basis points or 1/4 to 1/2 percent.

Mortgage rates are influenced by various factors, including down payments, credit scores, and individual credit histories. Therefore, while the Fed rate cut is a positive sign, it is advisable for homebuyers to consult directly with lenders for the most accurate and up-to-date mortgage rates.

Future Rate Expectations

Looking ahead, the Federal Reserve has indicated potential further rate cuts, anticipating an additional 50 basis points or a .5% drop by the end of 2024, followed by a total of 1% in 2025 and another .5% in 2026. However, it's crucial to remember that these projected cuts do not have a guaranteed impact on mortgage rates. Economic conditions can fluctuate and may affect this trajectory, so staying informed and adaptable is key.

Immediate Market Reactions

Although only a few days have passed since the announcement, there has been a noticeable uptick in activity within the real estate market. An increase in inquiries from both buyers and sellers highlights the growing interest in making moves and seeking clarity around these changes.

What to Expect in the Coming Year

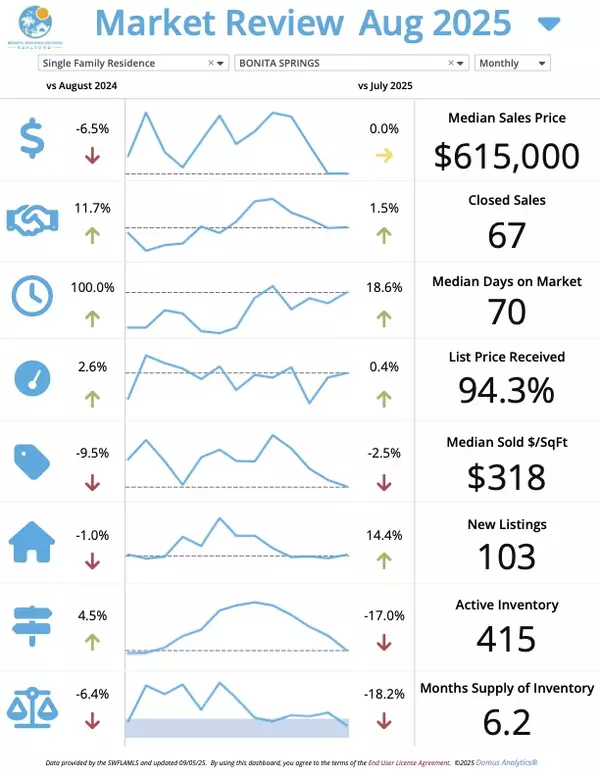

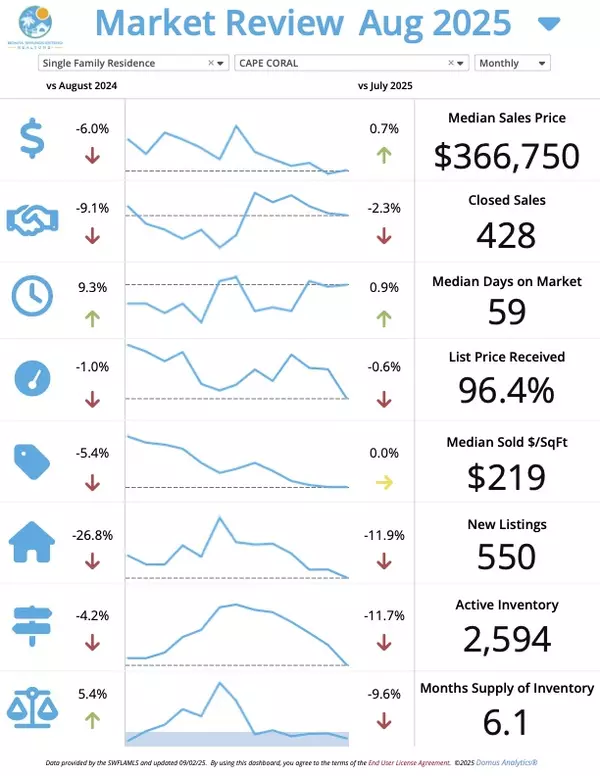

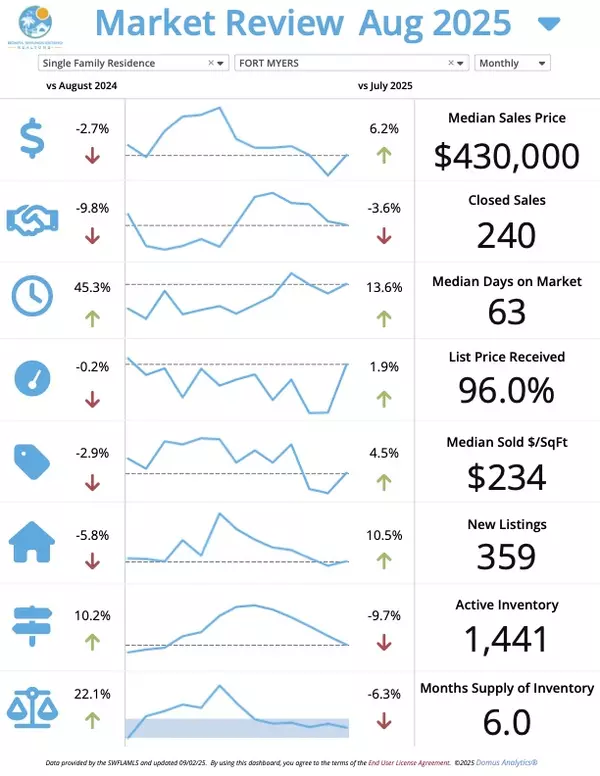

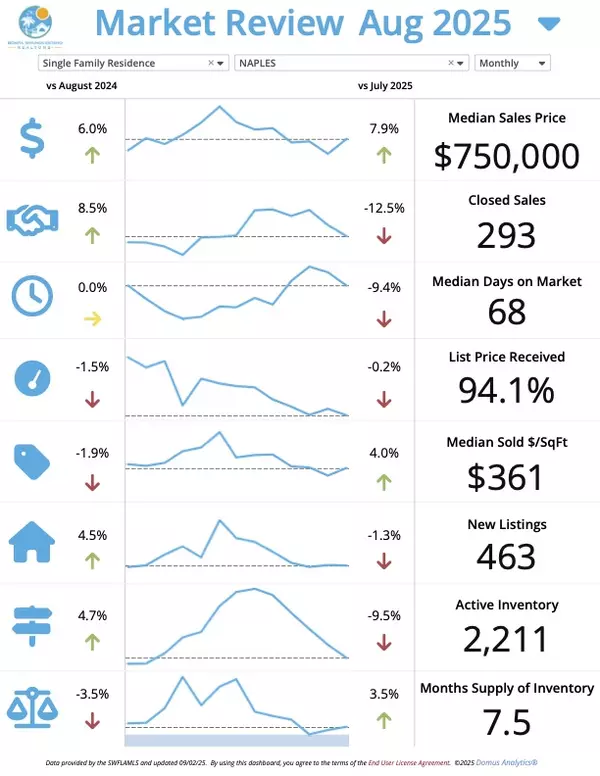

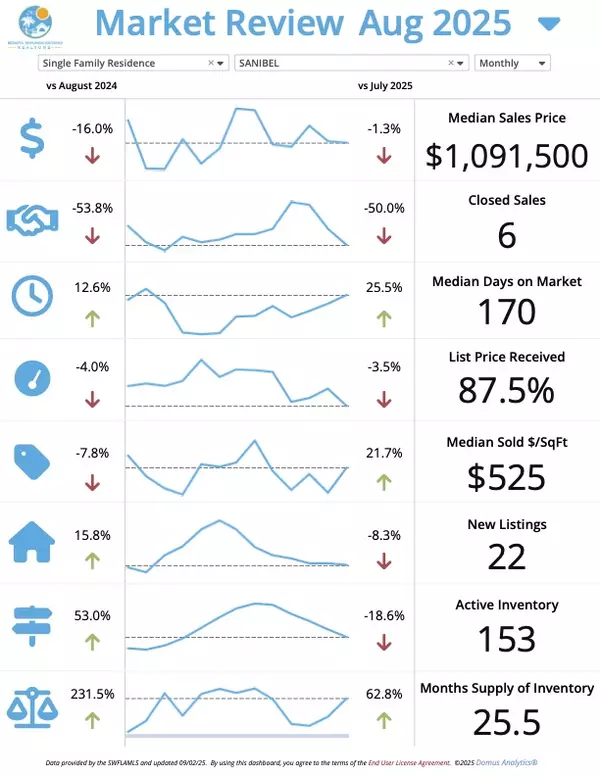

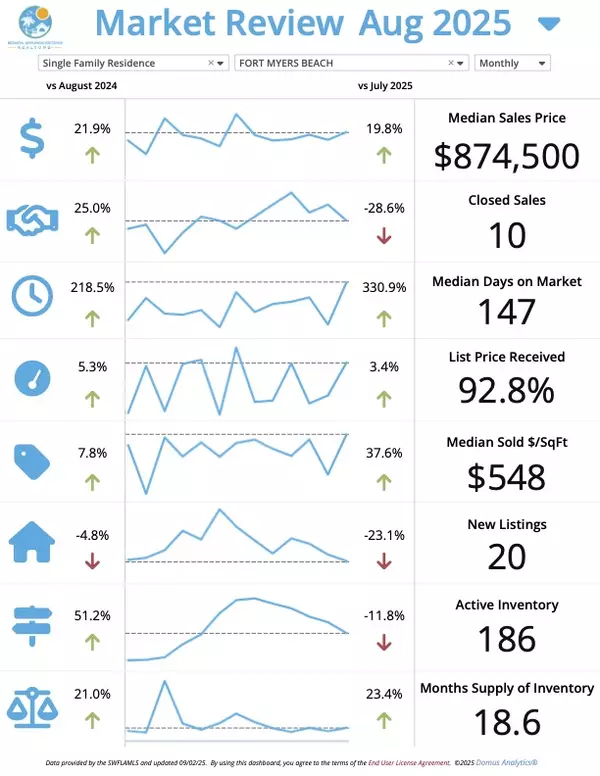

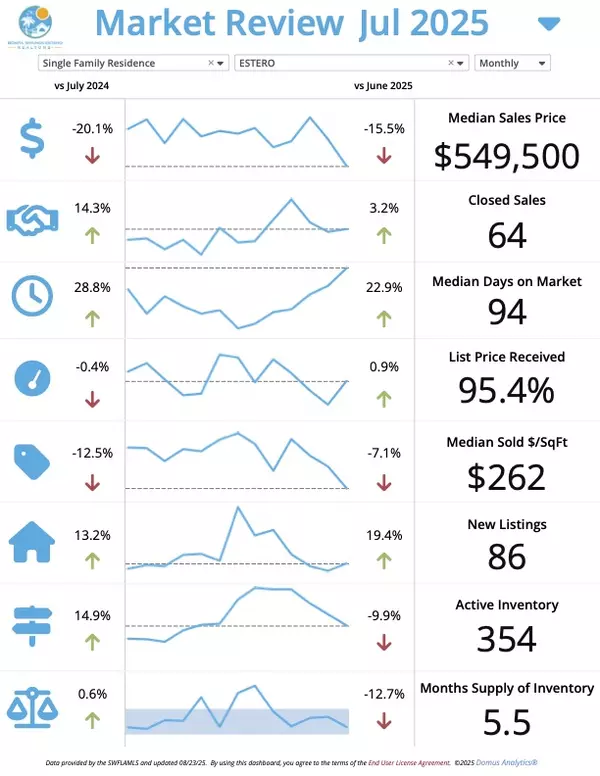

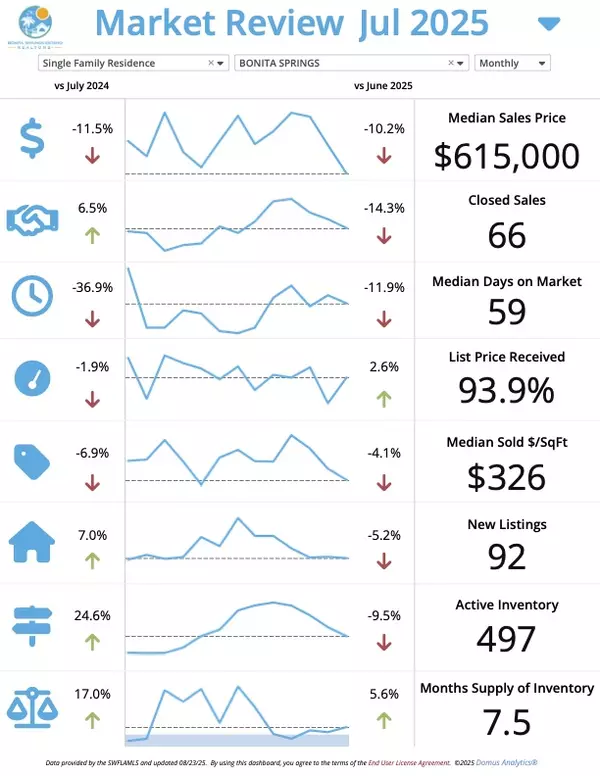

I foresee modest growth in the SWFL real estate market over the next year. The past year has been challenging due to elevated mortgage rates, inflation, and general economic uncertainty. However, certain factors signal potential improvement. For example, as insurance rates, which recently spiked, appear to be stabilizing and new insurers are entering the state, we could see some relief for buyers. Furthermore, the ongoing rebuilding efforts in areas like Sanibel and Fort Myers Beach will likely drive tourism and increase demand for properties in our region.

Final Thoughts

If you have any questions about how these recent changes may impact your home search or the overall market, I'm here to help! For those specifically interested in mortgage options, you can reach out to Aaron Bohn at TBF Mortgage on his website here.

If you have further questions or need assistance, feel free to contact me. The landscape is changing, and I'm here to navigate it with you!

Josh Bohling LPT Realty

Cell 239-898-1419

Disclaimer: Please note that this article is for informational purposes only and does not constitute lending advice. Always consult a qualified mortgage professional for specific guidance tailored to your situation.

Categories

Recent Posts